Start your claim and answer the questions about your situation. For example as a parent you could receive a total.

Parental Leave And Payment Eligibility Table Employment New Zealand

Newly arrived residents usually have.

How to be eligible for parenting payment. Family Tax Benefit A and B Newborn Upfront Payment and Newborn Supplement. Well tell you when your first payment is after we approve your claim. Answer the Eligibility check questions first.

Once youve completed your claim check your Centrelink online account through myGov. Depending on other circumstances this parent might also be eligible for payments like Rent Assistance. It will tell you all of the following.

Complete the following steps to claim Parenting Payment. Another person caring for a child under exceptional circumstances. When youll get your first payment.

How much Parenting Payment you can get depends on your and your partners circumstances. To be eligible for Parental Leave Pay you must. Parenting Payment is a fortnightly payment.

Child Care Subsidy if using approved or registered care. The payments will arrive on the 15th of each month and parents could get as much as 3600 per eligible child depending on age and their adjusted. Parents who share custody of a child have some rules -- including whos eligible for a payment.

The child must live with you. When paid parental leave can start how long it is for and extra entitlements if your baby is premature. The checks for parents will be paid through direct deposit paper check or debit card and sent out on the 15th of every month the IRS said Monday.

Heres an example of how Australian Government parenting payments work. When weve accepted your claim. A single parent with no income no assets and dependent children might be eligible for.

Well tell you when your first payment is after we approve your claim. Parenting Payment is a fortnightly payment. To get Parenting Payment you must be the principal carer of a child.

Kids between the ages. Be the primary carer of a newborn or recently adopted child. How to apply for paid parental leave to help make up for lost income when you have a new baby.

Parenting Payment Single PPS is an income support payment available to single parents and other principal carers who have sole or primary responsibility for the care of a young child. To get Parental Leave Pay you need to be the primary carer of your newborn or adopted child and one of the following. Well tell you if you need to do anything else to complete your claim.

Most families eligible to receive the payments dont have to do anything right now according to the IRS. You cannot get One-Parent Family Payment if you have joint equal custody of a. These parents may be eligible for PPS until their youngest child turns 8 eligibility depends on.

The agency will use the information filed on 2020 tax returns first to determine. The law established the upper-income limit for these payments at 150000 per year for a family or 75000 per year for a single parent. The maximum and minimum payments you will receive when on paid parental leave deductions from paid parental leave and the tax code to use.

Information to help you make a choice between Veteran Payment and your income support payment. Sign in to myGov. To qualify for One-Parent Family Payment you must.

The first is to claim each eligible child ahead of time on. Under the current Child Tax Credit parents have had two routes for receiving the money neither of which involve monthly cash payments. The initial primary carer of an adopted child placed in your care by an authorised party for the purpose of adoption.

On the day you claim Parenting Payment you must be an Australian resident and in Australia. You may have to wait before your Parenting Payment starts. If you have dependents who are 17 years of age or younger they can each count toward the new child tax credit.

The payments are expected to reach 39 million American households covering 88 percent of children in the United States according to the Department of the Treasury. Review and confirm your claim. In order to qualify for the payment you also need to meet residence rules and income and asset tests.

Be the parent step-parent adoptive parent or legal guardian of a relevant child this means a child under the relevant age limit be the main carer of at least one relevant child. However the amount theyre eligible for depends on their age. Example of parenting payments.

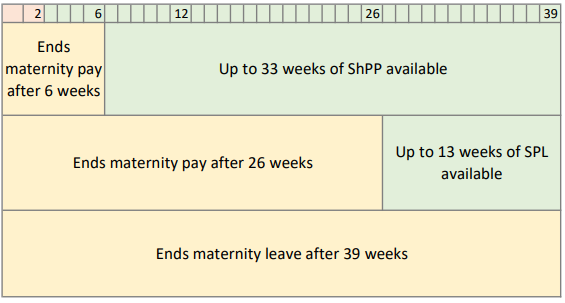

Have worked 10 of the 13 months before the birth or adoption of your child and 330 hours in that 10 month period just more than one day a week with no more than a 12-week gap between two consecutive working days. When your payment will start. We may ask you to complete other forms to submit your claim.

You need to be an Australian resident and in Australia on the day you claim your Parenting Payment. Select Parenting Payment.

Family Matters Issue 84 Child Support And Welfare To Work Reforms Australian Institute Of Family Studies

Working Families Shared Parental Leave Sharing Or Splitting Up Leave Working Families

Centrelink Coronavirus Payment Faqs What When Tax Reporting

Government Parenting Payments Raising Children Network

Carer Payment Child A New Approach Report Of The Carer Payment Child Review Taskforce Department Of Social Services Australian Government

550 Vs 750 Vs 1 500 Which Coronavirus Cash Payment Do I Get

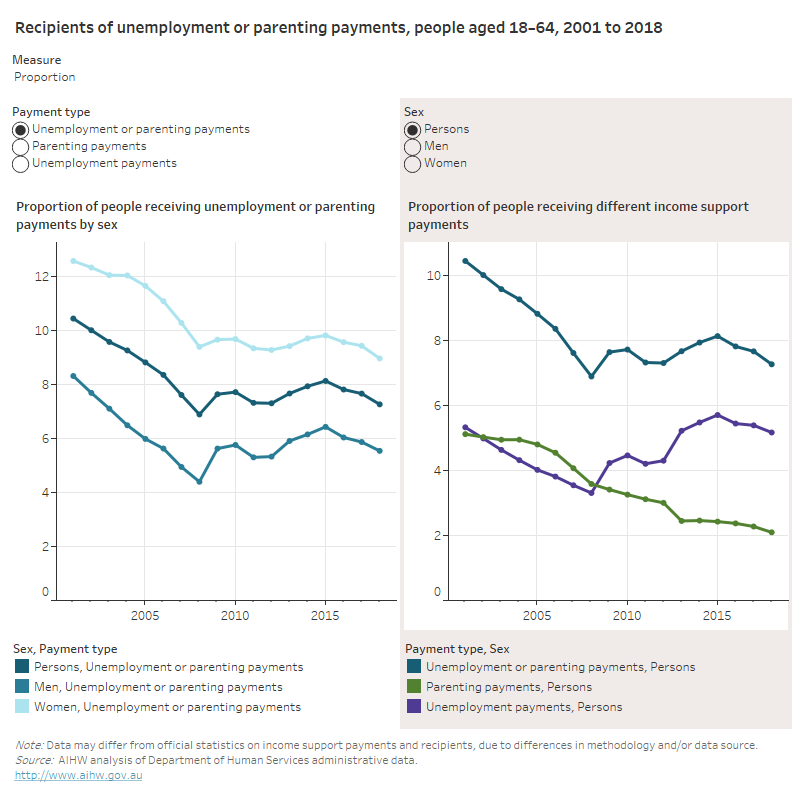

Unemployment And Parenting Income Support Payments Australian Institute Of Health And Welfare

Unemployment And Parenting Income Support Payments Australian Institute Of Health And Welfare

Working Families Shared Parental Leave Sharing Or Splitting Up Leave Working Families

Post a Comment

Post a Comment